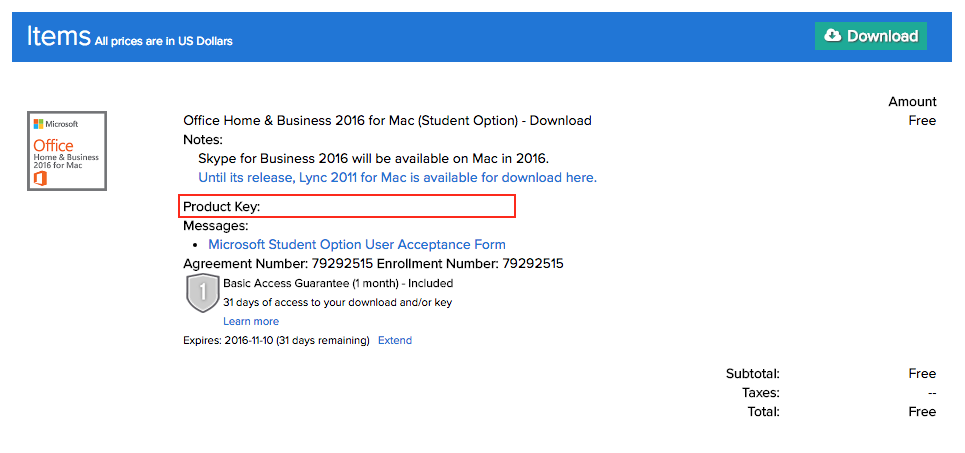

- #Office home & business 2016 for mac (student option) download how to

- #Office home & business 2016 for mac (student option) download 64 Bit

- #Office home & business 2016 for mac (student option) download full

- #Office home & business 2016 for mac (student option) download professional

If you're purchasing physical disc, the disc will include both versions which you can select at time of installation.

If you are purchasing digital download you can select either option at the time of download.

#Office home & business 2016 for mac (student option) download 64 Bit

Office 2016 Standard is available in both 32 and 64 bit versions.

#Office home & business 2016 for mac (student option) download professional

The rules in the publication apply to individuals.Compare main features of Home & Student, Home & Business, Standard and Professional editions

#Office home & business 2016 for mac (student option) download how to

#Office home & business 2016 for mac (student option) download full

If the use of the home office is merely appropriate and helpful, you cannot deduct expenses for the business use of your home.įor a full explanation of tax deductions for your home office refer to Publication 587, Business Use of Your Home. So, if you use a whole room or part of a room for conducting your business, you need to figure out the percentage of your home devoted to your business activities. Generally, deductions for a home office are based on the percentage of your home devoted to business use. The structure does not have to be your principal place of business or the only place where you meet patients, clients, or customers. You can deduct expenses for a separate free-standing structure, such as a studio, garage, or barn, if you use it exclusively and regularly for your business. If you conduct business at a location outside of your home, but also use your home substantially and regularly to conduct business, you may qualify for a home office deduction.įor example, if you have in-person meetings with patients, clients, or customers in your home in the normal course of your business, even though you also carry on business at another location, you can deduct your expenses for the part of your home used exclusively and regularly for business. You must show that you use your home as your principal place of business. For example, if you use an extra room to run your business, you can take a home office deduction for that extra room. You must regularly use part of your home exclusively for conducting business.

Regardless of the method chosen, there are two basic requirements for your home to qualify as a deduction: Requirements to Claim the Home Office Deduction Generally, when using the regular method, deductions for a home office are based on the percentage of your home devoted to business use. These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation. Taxpayers using the regular method (required for tax years 2012 and prior), instead of the optional method, must determine the actual expenses of their home office. This new simplified option can significantly reduce the burden of recordkeeping by allowing a qualified taxpayer to multiply a prescribed rate by the allowable square footage of the office in lieu of determining actual expenses. The standard method has some calculation, allocation, and substantiation requirements that are complex and burdensome for small business owners. Simplified Optionįor taxable years starting on, or after, Janu(filed beginning in 2014), you now have a simplified option for computing the home office deduction (IRS Revenue Procedure 2013-13, January 15, 2013).

The home office deduction is available for homeowners and renters, and applies to all types of homes. If you use part of your home for business, you may be able to deduct expenses for the business use of your home.

0 kommentar(er)

0 kommentar(er)